Billing for “units x price = cost” is not so tough, wouldn’t you agree? Of course, retail energy billing for large commercial and industrial end users is a tad more complex. And by “a tad” we mean, of course, about a metric ton. In this article, learn how EnSite Safari Suite has grown up with the C & I market to become a powerhouse of complex energy pricing for large-scale consumers of electricity and natural gas.

From General to Specific: Safari Complex Energy Pricing

Safari Suite does a lot of great things. One reason for this blog is to isolate and define particular market scenarios that have informed the “DNA” of the system, and one of these is the commercial and industrial retail energy marketplace.

While it’s true that Safari is a leader in EDI automation, customer care, commodity management, third-party system integration, cycle billing, and more, the system’s ability to manage complex energy pricing for demanding high-volume end users has contributed greatly to the success of the product in the retail energy space. As energy marketers know, the process of negotiating and closing a sale for complex energy pricing products, while complicated in itself, is only half the battle. The other half is to price, invoice, settle, and audit high-volume sales consistently and efficiently over time.

Safari Suite helps our customers join these two halves into a cohesive whole — and that’s how they win in their markets.

Safari Pricing via Price Components

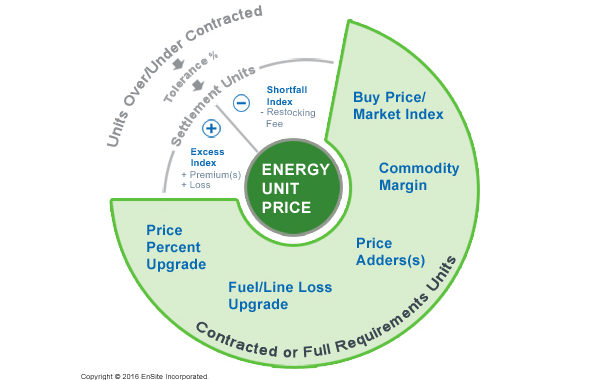

Safari pricing employs “building block” price components that build upon the “base” floating Index or fixed Buy Price to assemble a complex invoiced sale price for commodity or other unit-based consumption (such as Basis or Demand). A wealth of “standard” price types are available, but it’s fairly common for Safari users to employ custom price types as well. Each of the price types discussed in this article can be thought of as standard types from which customized pricing can be constructed.

Retail energy pricing can be divided into two broad categories: pricing for fixed or contracted units (with or without settlement) or full requirements pricing. Within each of these two categories, Safari supports fixed price and index-priced offerings. Hybrid “hedged” indexed pricing includes the ability to trigger and track unlimited fixed price “blocks” of the contracted volume.

In addition to the base Buy Price/Index component, Safari price types support useful pricing “upgrade” components applicable to the various price offerings.

Margin/Adders/Fixed Basis – “plug-in” dollar amounts for Margin, a fixed Basis price for natural gas, and multiple Adders are available as additive price components for many price types.

Percent Upgrade – a user-entered percentage value can be automatically applied to the assembled price (e.g., Buy Price/Index Price + Margin times “X” percent) and added to the final unit price. Applicable to both contracted/full requirements unit prices and settlement (excess) unit prices.

Fuel Upgrade – a published Utility Tariff Rate (i.e., a managed rate specific to a Utility) is user-selected to upgrade the assembled price by the Utility’s published loss factor to recapture fuel/line loss in the metered unit price. Applicable to contracted/full requirements unit prices and settlement (excess) unit prices. (Note: Safari also features billed unit upgrades and special line-item unit pricing for loss units).

Full Requirements Pricing

Full requirements pricing types in Safari share the basic characteristic that unit volume does not impact how commodity or other units are priced. The pricing mechanism prices all units the same. The differences among these price types allow marketers to choose between a fixed price or an indexed price, as well as other components that affect the final sale price (described above).

In addition to standard fixed price and index priced offerings, Safari full requirements price types are available for higher/lower index pricing (where the higher or lower of two specified index prices are used at billing time). Additionally, cap/collar/floor pricing is available.

A full requirements “base load” deal may also be utilized to price settlement units for one or more fixed unit deals that are pricing contracted units (see Fixed Unit Pricing and Settlement below for other settlement options.)

Safari Price Indexes

Price types may utilize a fixed “buy price” or an index rate, called a Pricing Rate in Safari. Rates are managed by Unit of Measure for specific commodities, and for specific frequencies (monthly, daily, hourly). Pricing Rates in Safari are typically managed as a mix of published rates (such as NYMEX rates) and in-house proprietary rates and rate blends. To quickly move published rate data into the system, Safari includes a dedicated import protocol for pricing rate values.

In addition to ‘standard’ pricing rates, Safari supports composite rate and WACOG rate maintenance. Composite Rates provide the user with the means to build a custom Pricing Rate that is an additive or averaged composite, or blend, of two or more “standard” Safari Pricing Rates. WACOG rates are based on prices and volumes of purchased natural gas supply packages tracked via Safari Supply Management.

There’s much more to learn about Safari Pricing Rates than can fit in this post. Fortunately, you can learn all about Safari rates and rate management at our recent blog post on the topic.

Fixed Unit Pricing and Settlement

Safari offers a wealth of fixed unit management and pricing options, which will be the topic of a future dedicated blog post. Here, we’ll cover the pricing basics in order to get an overview of user options for fixed unit pricing.

Base Price – Safari fixed unit deals can be managed for fixed price and index priced pricing products, as well as “hybrid” types that provide for indexed baseline pricing supporting triggered fixed price blocks (see below). The “base” price is applicable to the contracted units for a given account/meter. For all such price types, users may also choose settlement indexes for pricing of any units over or under the contracted units (with “under” units priced as customer credits). Users also have the option of pricing contracted units only, with no settlement pricing on the invoice.

Settlement – Safari includes options for both daily and monthly settlement. Monthly settlement may be for monthly units or aggregated daily units.

For pricing units consumed over the fixed amount specified for the customer, the selected Over index (Safari Pricing Rate) will price the units, along with optional Premium and Fuel components (see above).

For pricing units not consumed by the Account, i.e., units short of the contracted volume, Safari utilizes the selected Under index. Users may also apply a “Restocking Fee,” which will reduce the customer’s credited price per unit by the user-assigned dollar amount.

The automated over/under pricing with user-input premiums for each means that users can employ the same pricing index for both excess and shortfall units.

Estimated Pricing

For Safari Prepay Billing, estimated pricing is fully supported. To create the Prepay Invoice, Safari utilizes a “parallel” set of pricing indexes that invoice Prepay customers for forward estimated index prices when published prices are not yet available. These indexes can be employed in standard Safari Price Types to pre-invoice for projected usage. For later period settlement, the actual index price is utilized by Safari to “true up” the originally priced units for the actual published index rate.

Hedged and Fixed Block Pricing

For natural gas, Safari supports sophisticated hedging price types that allow users to fix the commodity price and assign a floating index to Basis, or to fix the Basis price and assign a floating commodity index. End users can then trigger specific volumes for a total fixed price per unit as needed up to the marketer’s cutoff, with any untriggered volumes priced at invoice time using the base price containing the floating index.

EnSite is currently developing Fixed Block pricing for electricity as well. Users will be able to establish baseline index-driven pricing for electricity units and to trigger fixed unit blocks for fixed pricing.

Learn More

You can learn more about how Safari Suite helps energy marketers exercise control over every aspect of their business and their data – visit the Safari Suite home page.